In Search Of… Those ‘Other’ Search Engines

Cheap SEO firms make promises about getting your site to the front page of 'hundreds' of search engines. So... what search engines are they talking about?

Get a Free Marketing Analysis and Consultation

Nowspeed can review your Website, SEO, PPC, Email or Social Media Campaigns and identify ways to make an immediate impact!

Something that never fails to make us cringe is when we stumble across advertising for basement-level SEO firms. These are the sorts of places whose idea of SEO-focused content for their own websites amounts to, “Number #1 SEO firm web developer in United States of USA will get your website site to front page #1 on Google Bing Yahoo 100s of directories and search engines.” Okay, that might be a slight exaggeration. But honestly, not by much. We’ve had the misfortune to sit through some downright painful pitches from companies asking us to outsource our SEO services.

The common refrain for these D-list SEO firms is, “We’ll make you show up on the first page on hundreds of search engines!” Sometimes it’s ‘dozens,’ but the message still amounts to the same thing: that the web is teeming with hundreds of other search engine besides Google and Bing, search sites that have vast audiences just waiting to stumble across your site. And those SEO firms tell you that THEY are the ones who can get you ranking on the first page for those hundreds of search engines.

So, what are these hundreds of search engines that the SEO folks are talking about?

If you ever want to see Spock with some truly epic sideburns, look for old episodes of “In Search Of…” You can find them on YouTube.

Now, to be fair, there ARE hundreds of search engines out there. That’s a fact. However, the majority of the ones that are actually useful and aren’t just a means for serving tons of spam tend to be very niche services. They aren’t catch-all search engines, but rather, sites tailored for very specific needs. For instance, there’s Boardreader, which is only for searching through online forums and message boards, and CC Search, which is a site that allows you to find images and other media in the public domain (useful if you need images for a website or music for a video). Or CrunchBase, which specializes in startup companies and the people involved in founding or running them.

There are lots and lots of these sorts of sites, but they aren’t your typical search engines for day to day use. So where are all the other ‘normal’ search engines that are on their way to knocking Google off of its lofty perch? Thanks to services like StatCounter, it’s pretty easy to find out about different web trends. One of the things they’ve kept track of for years is the popularity of just about every typical search engine on the web. And their stats are a little different than a lot of the other search statistics thrown around online, for a key reason–they measure unique users. If one person uses Google 300 times in a day, and another searches on Bing once that same day, NetMarketShare scores one user for Google, and one user for Bing. They aren’t looking at overall traffic, but rather, what each individual person is doing. And that makes sense, because the person who does hundreds of Google searches a day is only representative of a single potential customer, no matter how many times they see your site pop up in the search results.

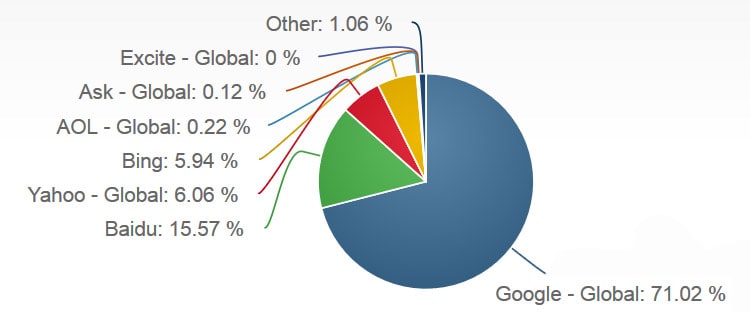

Let’s take a moment to check out the hundreds of up and coming search engines that the entirety of the web-surfing population on Earth were using in September, 2014.

Somewhere, a Lycos exec is weeping softly. Yes, Lycos actually still exists. (2020 update: Lycos still exists. Although their claim that “LYCOS is one of the original and most widely known Internet brands in the world” is questionable. And I have my doubts about its functionality, as a search for “Google” turned up no results, but a search for “Google search engine” worked fine. Weird.)

Okay, so… there’s not a whole lot of diversity as far as search engine use goes.

There is a bit of a rainbow going on there, but not nearly as much as one might of hoped. It’s more like the basic box of Crayola crayons with 8 crayons in it, rather than that epic 96-pack with the built-in crayon sharpener (let us never speak of RoseArt crayons… ever). Keep in mind, these are statistics for the entire world, rather than just the US or North America or Europe.

Are there any surprises in here? There’s Google with more than 70%. Not a shocker there.

The next closest is… Baidu? That might take a little explanation. Baidu is an extremely popular search engine. The problem being, it’s popular in China. Because it’s based in China. And it’s entirely in Chinese. It achieves a 15% share of search users because it caters specifically to the needs of Chinese users, and plays nice with China’s militant censorship rules. Rules that are so strict that Google pulled up stakes and fled the country years ago, taking their employees with them. If you are specifically targeting Chinese customers in China, then it pays to do research into how to get your site ranking well on Baidu. Otherwise, not so much.

Anyways, getting back on track. Third place goes to Yahoo, with a whopping 6%. Then there’s Bing, with just under 6 percent. Wait. Bing lost to Yahoo? Ouch.

Fifth place goes to AOL. Um. Yeah. The folks you used to get free Frisbees from in the mail. And they’ve just got a smidgen over one-fifth of 1%. Meaning that if this were a survey of 100 people, someone’s lower legs would be the sole user of AOL Search. To make it worse, AOL actually just licenses Google’s search engine. So really, AOL counts for Google.

So far, in the top five search engines in the world, we’ve got Google, a Chinese-only search engine, Yahoo, Bing, and Google again just masquerading as AOL. Just five search engine sites account for 98.81% of all the web users on earth, and of those, only three actual search engines are in play (sorry, Baidu).

The rest of the pack, sadly, aren’t the up and comers, the new kids on the block who are going to be the next big thing that we all need to keep an eye on (in fact, they’re about as relevant as New Kids on the Block). They’re just zombies who don’t know they’re dead yet. Ask.com, with 0.12% market share, you might actually better remember as Ask Jeeves. Things got so bad for them that they more or less abandoned the search engine scene in 2010 and outsourced their search results to an unnamed provider. Incidentally, recently we got a visitor to our site from Ask.com. If that was you, hi! Also, I have questions.

After that, there’s Excite. Excite. Excite? Things are so bad for them that they don’t even merit 0.01% of the world population. They got mathematically rounded right off to zero. In a survey of a hundred people, we couldn’t even find someone’s big toe that used the site. What could possibly have happened for them to fall so far?

I swear, I did not travel back in time to get this screenshot. If you don’t believe me, go look for yourself. (2018 update: IT STILL HASN’T CHANGED.) (2020 update: It’s finally changed. But I’m leaving that gloriously ugly screenshot in place. Also, their site isn’t secure. WTF?)

Oh. Oh dear. Oh god. No no no. The horror. The horror.

The even sadder thing is, if you look closely at the search results they generate, you can see that they’re actually provided by Dogpile. Holy cow, Dogpile is still a thing? And acttttuuualllly, if you look at Dogpile’s site, you’ll see that they simply serve search results from Google and Yahoo. So really, Excite is just a front for Dogpile which is a search for Google and Yahoo.

That’s it. That’s all of them. Every other search engine on earth is used by just over a combined 1% of the planet. Many of them are like those super-specialized ones that I described above. Some of them serve a very specific cultural demographic, like Yandex, a Russian search engine. But all the search engines that you’re ever going to have to worry about (at least in the foreseeable future) are those three that get repeated over and over, ad nauseum: Google, Yahoo, and Bing.

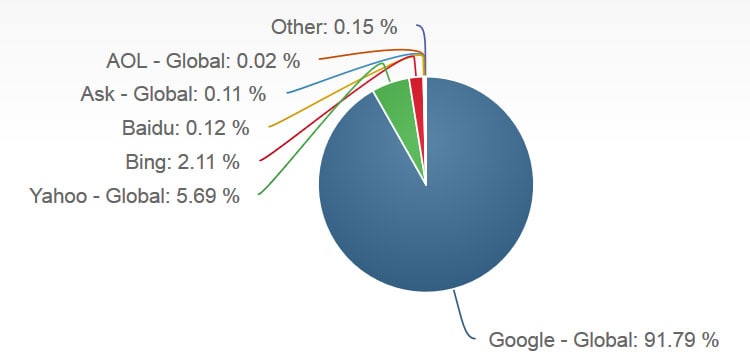

Now, to be fair, that pie chart I posted above is only for people doing web searches on their desktop and laptop computers. If you’ve looked around our site or kept abreast of internet trends, you’ll know that just this year, the number of mobile searches–those done on phones and tablets–surpassed those done on traditional computers. So maybe we’re missing something. The up-and-comers might be hiding amongst mobile searches. Let’s take a quick glance at who’s using what search engine on their mobile devices:

Actually, that kinda looks like a dead Pac-Man. A dead Pac-Man that ate all the other search engines.

Or not. Yeah, the picture is even more absurdly lopsided on the mobile front. And remember, this isn’t an analysis of the number of searches being done, but rather, the number of searchers. More than 90% of the people in the world are using Google for their mobile searches. The big three swallow up 99.59% of the market. There’s no reason to beat this dead horse any more than we already have.

So what was the purpose of all of this? The problem with SEO is that, done wrong, it can be dangerous to your business. When somebody who wants to sell you SEO services talks about submitting your site to dozens or hundreds of search engines, that should be your first clue that they really don’t know what they’re talking about, but they’re hoping that you don’t know either. They’re sitting at the poker table with a 2 of hearts and a 7 of spades, trying to bluff you into thinking they’ve got something worth your money, when the reality is, they don’t. At best, the money you give them will accomplish nothing. Unfortunately, it’s more likely that they’ll burn you by using black hat SEO techniques that will get you penalized by Google for associating with spammy websites.

If you ever have a question about SEO or search engines or how to go about getting your business on the map, please contact us. We honestly enjoy helping others. We want small and growing businesses to succeed. At the end of the day, that’s what makes the work worth it.

So let's

talk.

We're always excited to dig into the details of your company and what strategy can help you meet your goals. So let's talk and lay out a plan for success!